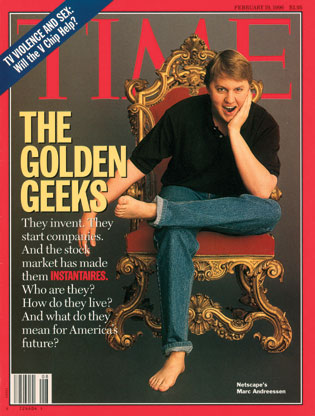

Two exchanges from an excellent Fortune interview that Andy Serwer conducted with Marc Andreessen.

The first one focuses on something I blogged about recently, which is the possibility of the invention of new jobs and careers that may occur on a large scale in the post-Industrial Age the way it did in the post-Agrarian Age. As Andreessen points out, though, there’s a hard and scary road getting to that point in our increasingly automated society.

The second is Andreessen’s prediction that cars will become an on-demand, shared good that will destroy the century-old ownership model. I have my doubts about the shared aspect, though I think fleets of driverless cars on demand will become a reality in cities.

_________________________

Andy Serwer:

We all understand that the Internet revolution is inevitable at this point, but it’s also kind of controversial. There are scads of new jobs at Facebook and Twitter and other places, but what about the ones that are destroyed by the inroads of technology into every industry? Are you actually creating more than you’re destroying?

Marc Andreessen:

Jobs are critically important, but looking at economic change through the impact on jobs has always been a difficult way to think about economic progress. Let’s take a historical example. Once upon a time, 100% of the United States effectively was in agriculture, right? Now it’s down to 3%. Productivity in agriculture has exploded. Output has never been higher. The same thing happened in manufacturing 150 years ago or so. It would have been very easy to say, “Stop economic progress because what are all the farmers going to do if they can’t farm?” And of course, we didn’t stop the progress of mechanization and manufacturing, and our answer instead was the creation of new industries.

Andy Serwer:

And the same story will play out with the Internet?

Marc Andreessen:

Right. So the jobs are something that happens in the end. But what happens first are improvements in consumer welfare. This is the part that doesn’t get much attention because jobs going away is a much scarier story. Improvements in consumer welfare are more diffuse, and it’s hard to specifically call them out. But it’s a really big deal. It’s a really big deal for people to have a lot more information. It’s a really big deal for people to be able to communicate and collaborate. One of the things that’s going to be huge in the future is the ability to get educated online. That’s a wave that’s going to hit in a major way in the next 20 years, and will be a huge improvement to consumer welfare all around the world. And so the gains to anybody with a screen and a network connection are absolutely phenomenal. It’s one of those things where everybody’s life keeps getting better. But you don’t get the creation without the destruction. And so there is a lot of turbulence, and will be a lot of turbulence.

_________________________

Andy Serwer:

Speaking of cars, you’ve talked about a shared economy where people will share cars. They won’t own cars. You see a little bit of that today, but is that really the way the world’s going?

Marc Andreessen:

So this is when I get really excited. This is another example of the impact of information transparency on markets. We are 90 years or so into cars. And we drive our cars around. And we own our cars. And then when we’re not in our cars they sit parked. So the average car is utilized maybe two hours out of the day. It sits idle for 90% of the time. The typical occupancy rate in the U.S. is about 1.2 passengers per car ride. And so even when the car is in motion, three-quarters of the seats are unfilled.

And so you start to run this interesting kind of thought experiment, which is what if access to cars was just automatic? What if, whenever you needed a car, there it was? And what if other people who needed that same ride at that same time could just participate in that same ride? What if you could perfectly match supply and demand for transportation?

Taken a step further, what if you could bring delivery into it? Two people were going to drive between towns, and there was also a package that needed to go. Let’s also put that in there so we can fill a seat with a package. Just run the thought experiment and say, “What if we could fully allocate all the cars, and then what if we could have the cars on the road all the time?”

And of course the answer is a whole bunch of things fall out of it. You’d need far fewer cars. The number of cars on the road would plummet by 75% to 90%. You’d instantly solve problems like congestion. You’d instantly solve a huge part of the emissions problem. And you’d cause a huge reduction in the need for gas. And then you’d have this interesting other side effect where you wouldn’t need parking lots, at least not anywhere near the extent that you do now. And so you could turn a lot of parking lots into parks.