The economist Alex Tabarrok participated in an interesting Q&A session at Quora, but I really wish I could ask him a follow-up on the exchange about Artificial Intelligence’s impact on the middle class. One point he makes is that the benefits of AI will flow to masses the way smartphones have. That sounds promising except that the diffuse nature of that particular technology has coincided by most estimates with a hollowing out of the middle. For instance, those phones have enabled Uber to destabilize the taxi industry, replacing solid jobs and small businesses with Gog Economy insecurity. Having a remarkably great tool in our shirt pockets isn’t necessarily a panacea for larger economic issues, and it’s possible the benefits from AI won’t cover the losses it creates.

The exchange:

Question:

Will the proliferation of affordable AI decimate the middle class?

Alex Tabarrok:

Here is how I think about these issues. The Artificial in AI can sometimes mislead so let’s start by getting rid of the A and asking instead whether more NI, Natural Intelligence will decimate the middle class. For example, will increasing education in China decimate the American middle class? I don’t think so.

As I said in my TED talk, the brainpower of China and India in the 20th century was essentially “offline.” Instead of contributing to the world technological frontier the people of China and India were just barely feeding themselves. China and India are now coming online and I see the increase in natural intelligence as one of the most hopeful facts for the future. It’s been estimated that a reduction in cancer mortality of just 10 percent would be worth $5 trillion to U.S. citizens (and even more taking into account the rest of the world). A reduction in cancer mortality is more likely to happen with a well-educated China than with a poorly educated China. So we have a huge amount to gain by greater NI.

In the case of low-skill labor the rise of China has hurt some US low-skill workers (although US workers as a whole are almost certainly better off due to lower prices). The US has historically had an abundance of highly-skilled labor and with greater education around the world we have less of a competitive advantage. In the case of high-skill labor, however, I think the opportunities for gains are much greater than with competition for low-skill labor. Ideas are what drives growth and ideas are non-rivalrous, they quickly spread around the world. The more idea creators the better for everyone. At the world level, for example, the standard of living and the growth rate of world GDP have both gotten larger as population has increased.

Greater foreign intelligence and wealth could be a threat if intelligence turns from production to destruction (this is also a potential problem with AI). We probably can’t keep China poor, even if we tried, and any attempt to try to do so would likely backfire in the worst possible way. Thus, if want to keep high-skill Chinese workers working on medical rather than military breakthroughs, we must preserve a peaceful world of trade. Indeed, peace and trade become ever more important the richer the world gets.

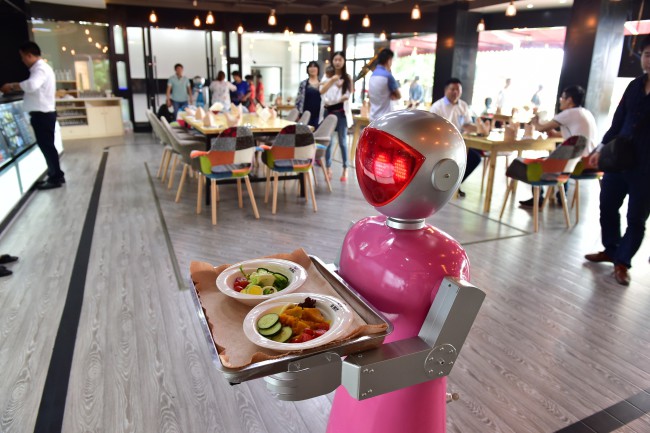

Now let’s turn from NI to AI. For the foreseeable future I see AI as being very similar to additional NI. Smart people in China aren’t perfect substitutes for smart people in the United States and there are also plenty of opportunities for complementarity. Similarly AI is not a perfect substitute for NI and there are plenty of opportunities for complementarity. An AI that drives your car, for example, complements your NI because it leaves more time for more productive tasks.

(What happens when AI does become a perfect substitute for NI? We could easily be 100 years or more from that scenario but my foresighted colleague, Robin Hanson, has a new book The Age of EM that discusses the implications of uploads, human intelligence copied into software—Hanson’s book is the most serious attempt in all of history to lay out the implications of a new technology but we may not know whether he is right for a long time.)

Thus, the analysis of AI and NI is similar except for one important fact. As Chinese workers become better educated a significant share of the gains will go to Chinese workers (although by no means all). AI, however, is produced by capital. But in our world capital isn’t scarce. The world is awash in capital and computing power is getting ever cheaper. AI isn’t like an oil field owned by a handful of people. AI will be cheap and ownership will be widespread. Just look at your cellphone—it’s faster and more powerful than a multi-million dollar Cray-2 supercomputer of 1990. Moreover, in 1990 there were only a handful of Cray-2s and today there are billions of cell-phone super-computers including hundreds of millions and soon billions in poor countries. The gains from AI, therefore, will flow not to capital but to consumers. So if anything the gains from more AI are even larger than the gains from more NI.•