If we were laying out a telephone system for America from scratch, we would never choose to put in place what is currently there, with its lines and wires mixing like a barrel of snakes It’s a mess. But you know what? It works. Complex systems usually grow organically through trial and error, and that’s probably a good thing. It’s often better to add on then raze and rebuild. Neatness conferred upon us by central planning is illusory. Our goal shouldn’t be to enforce order but rather to opt for what works.

From a recent interview with economist John Kay at Five Books:

“Question:

You have described economics and business as the last bastions of modernism. What do you mean by that?

John Kay:

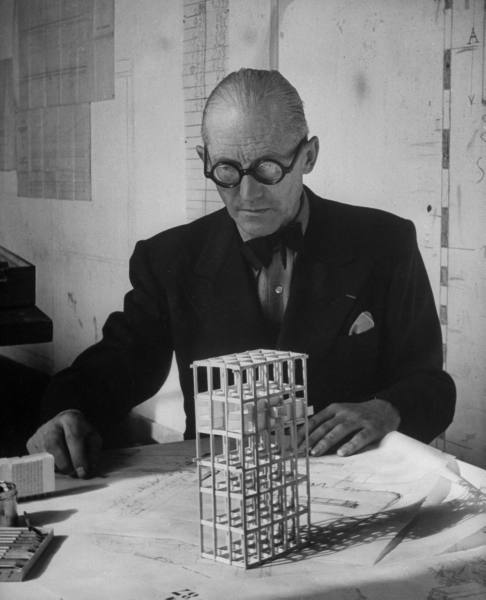

I think they are the last bastions of the idea that you can redesign the world in accordance with a rationally designed blueprint. Modernism in the twentieth century went through areas such as art, architecture and the humanities with the idea that we could rethink everything from the ground up and that we understood enough about the world to do that. I’ve come to believe that we don’t. But people still think they can analyse and structure economies as if they were a mechanical system and that they can do the same in business. So in the same way that Le Corbusier said – wrongly – that a house is a machine for living in, it exemplifies the idea that a business or an economy can be structured from first principles in the same way.

Question:

And ignores the social context within which economies and businesses work.

John Kay:

They are organic entities that evolve over time and operate within a social context. You can’t look at them independently of that.

Question:

Are the economic and financial ructions we’ve been experiencing in recent years due in part to the failure of economists and business leaders to appreciate this?

John Kay:

You can’t understand how the financial crisis came about without understanding the politics of the relationship between the financial sector and government and the anthropology of the cultures of these organisations, or indeed without appreciating the history of bubbles and financial crises.”

Tags: John Kay