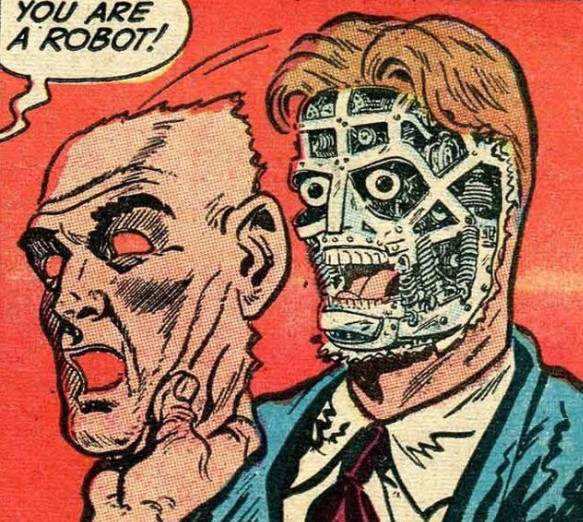

In the Digital Age, robots aren’t easy to identify.

That’s a problem since some, including Bill Gates, have recently suggested America tax them. On the face of it, that seems like a good idea, but the picture gets fuzzier the longer you stare at the situation.

Consider Uber, for instance. The company, using just algorithms, disrupted the taxi industry, undermining solid working-class jobs and replacing them with piecemeal precariousness, while employing very few workers in its own middleman function. Because it doesn’t utilize what we’d traditionally define as robots, it wouldn’t be taxable by the Gates standard. Even if we classify these computer systems as robotics and wanted to levy algorithm-centric companies like Uber–or Netflix or Amazon or Spotify–their effect on the economy, while real, is also amorphous.

Let’s say now that driverless becomes realistic within a decade. This capability would remove Uber’s freelance drivers from behind the wheel. Because autonomous cars are considered robotics, they could be taxed, which would create more resources for education and social-welfare programs. But in that scenario, couldn’t Uber just delay its transition until a more politically advantageous moment? That would be a lose-lose outcome from a purely economic viewpoint, since companies in other countries would likely move forward with this innovation and outstrip its U.S.-based counterpart.

Even with actual robots, it’s not so simple. For instance: Are Roombas taxed? We don’t know if they’re actually eliminating jobs or just toil. I don’t have any good answer in regards to this problem, but I don’t know that anyone else, Gates included, currently has one either.

In a smart Financial Times piece, philosopher Luciano Floridi cuts to the heart of the matter, arguing that seemingly easy answers to the situation just birth far more thorny questions. An excerpt:

We are laying down foundations for the mature information societies of the near future, so we need new ethical frameworks to determine which forms of artificial agency we are happy to see flourishing in them. Against this background, the EU’s initiative provokes mixed feelings: excitement at the aspiration but disappointment at the implementation. There is too much fantasy and too little realism.

Consider two key issues: jobs and responsibilities. Robots replace human workers. Retraining unemployed people was never easy, but it is more challenging now that technological disruption is spreading so rapidly, widely and unpredictably. There will be many new forms of employment in other corners of the infosphere — think of how many people have opened virtual shops on eBay. But new and different skills will be needed. More education and a universal basic income may mitigate the impact of robotics on the labour market.

Society will need more resources. Unfortunately, robots do not pay taxes. And more profitable companies are unlikely to pay enough extra taxes to compensate for the loss of revenues. So robots cause a higher demand for taxpayers’ money and a lower supply of it.

How can one get out of this tailspin? The report correctly identifies the problem. But its original recommendation of a robo tax on companies that employ robots — a proposal that did not survive into the final text approved the parliament — may not be feasible, for what counts as a robot? It may also work as a disincentive to innovation.•