In a wonderful Backchannel piece, historian Leslie Berlin answers two key questions: “Why did Silicon Valley happen in the first place, and why has it remained at the epicenter of the global tech economy for so long?”

Sharing granular details (before the name “Silicon Valley” was popularized in 1971, the area was known as “Valley of the Heart’s Delight”) and big-picture items (William Shockley’s genius drew talent to the community, and his bizarre paranoia dispersed them), Berlin provides a full-bodied sense of the place’s past, something she says continues to be of interest to the latest wave of technologists.

The short answer to the two questions posed is that there was confluence of technical, cultural and financial forces in this place in a relatively short span of time, and these same factors continue to sustain the area’s growth. (Oh, and immigration helps.) An excerpt from the “Money” section:

The third key component driving the birth of Silicon Valley, along with the right technology seed falling into a particularly rich and receptive cultural soil, was money. Again, timing was crucial. Silicon Valley was kick-started by federal dollars. Whether it was the Department of Defense buying 100% of the earliest microchips, Hewlett-Packard and Lockheed selling products to military customers, or federal research money pouring into Stanford, Silicon Valley was the beneficiary of Cold War fears that translated to the Department of Defense being willing to spend almost anything on advanced electronics and electronic systems. The government, in effect, served as the Valley’s first venture capitalist.

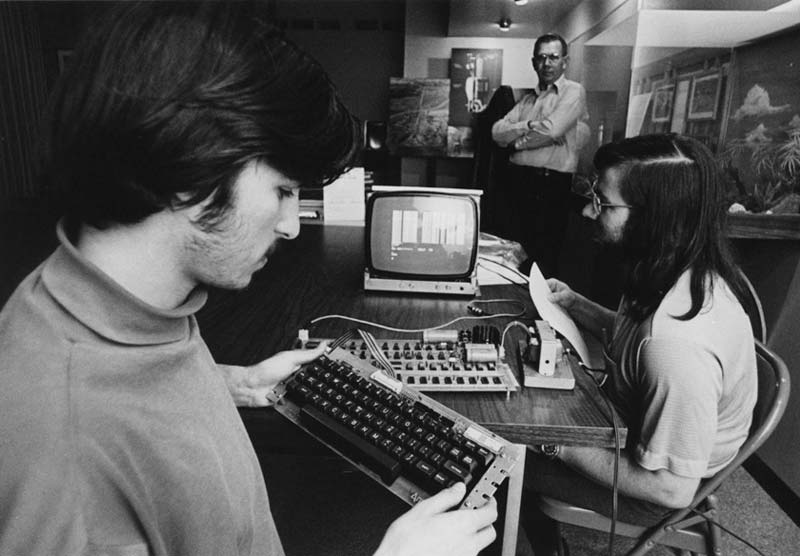

The first significant wave of venture capital firms hit Silicon Valley in the 1970s. Both Sequoia Capital and Kleiner Perkins Caufield and Byers were founded by Fairchild alumni in 1972. Between them, these venture firms would go on to fund Amazon, Apple, Cisco, Dropbox, Electronic Arts, Facebook, Genentech, Google, Instagram, Intuit, and LinkedIn — and that is just the first half of the alphabet.

This model of one generation succeeding and then turning around to offer the next generation of entrepreneurs financial support and managerial expertise is one of the most important and under-recognized secrets to Silicon Valley’s ongoing success. Robert Noyce called it “re-stocking the stream I fished from.” Steve Jobs, in his remarkable 2005 commencement address at Stanford, used the analogy of a baton being passed from one runner to another in an ongoing relay across time.•