In 1996, in response to the 1992 Russo-American moratorium on nuclear testing, the US government started a programme called the Accelerated Strategic Computing Initiative. The suspension of testing had created a need to be able to run complex computer simulations of how old weapons were ageing, for safety reasons, and also – it’s a dangerous world out there! – to design new weapons without breaching the terms of the moratorium. To do that, ASCI needed more computing power than could be delivered by any existing machine. Its response was to commission a computer called ASCI Red, designed to be the first supercomputer to process more than one teraflop. A ‘flop’ is a floating point operation, i.e. a calculation involving numbers which include decimal points (these are computationally much more demanding than calculations involving binary ones and zeros). A teraflop is a trillion such calculations per second. Once Red was up and running at full speed, by 1997, it really was a specimen. Its power was such that it could process 1.8 teraflops. That’s 18 followed by 11 zeros. Red continued to be the most powerful supercomputer in the world until about the end of 2000.

I was playing on Red only yesterday – I wasn’t really, but I did have a go on a machine that can process 1.8 teraflops. This Red equivalent is called the PS3: it was launched by Sony in 2005 and went on sale in 2006. Red was only a little smaller than a tennis court, used as much electricity as eight hundred houses, and cost $55 million. The PS3 fits underneath a television, runs off a normal power socket, and you can buy one for under two hundred quid. Within a decade, a computer able to process 1.8 teraflops went from being something that could only be made by the world’s richest government for purposes at the furthest reaches of computational possibility, to something a teenager could reasonably expect to find under the Christmas tree.

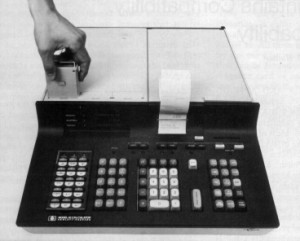

The force at work here is a principle known as Moore’s law. This isn’t really a law at all, but rather the extrapolation of an observation made by Gordon Moore, one of the founders of the computer chip company Intel. By 1965, Moore had noticed that silicon chips had for a number of years been getting more powerful, in relation to their price, at a remarkably consistent rate. He published a paper predicting that they would go on doing so ‘for at least ten years’. That might sound mild, but it was, as Erik Brynjolfsson and Andrew McAfee point out in their fascinating book, The Second Machine Age, actually a very bold statement, since it implied that by 1975, computer chips would be five hundred times more powerful for the same price. ‘Integrated circuits,’ Moore said, would ‘lead to such wonders as home computers – or at least terminals connected to a central computer – automatic controls for automobiles and personal portable communications equipment’. Right on all three. If anything he was too cautious.•

__________________________________

Note that in this future world, productivity will go up sharply. Productivity is the amount produced per worker per hour. It is the single most important number in determining whether a country is getting richer or poorer. GDP gets more attention, but is often misleading, since other things being equal, GDP goes up when the population goes up: you can have rising GDP and falling living standards if the population is growing. Productivity is a more accurate measure of trends in living standards – or at least, it used to be. In recent decades, however, productivity has become disconnected from pay. The typical worker’s income in the US has barely gone up since 1979, and has actually fallen since 1999, while her productivity has gone up in a nice straightish line. The amount of work done per worker has gone up, but pay hasn’t. This means that the proceeds of increased profitability are accruing to capital rather than to labour. The culprit is not clear, but Brynjolfsson and McAfee argue, persuasively, that the force to blame is increased automation.

That is a worrying trend. Imagine an economy in which the 0.1 per cent own the machines, the rest of the 1 per cent manage their operation, and the 99 per cent either do the remaining scraps of unautomatable work, or are unemployed. That is the world implied by developments in productivity and automation. It is Pikettyworld, in which capital is increasingly triumphant over labour. We get a glimpse of it in those quarterly numbers from Apple, about which my robot colleague wrote so evocatively. Apple’s quarter was the most profitable of any company in history: $74.6 billion in turnover, and $18 billion in profit. Tim Cook, the boss of Apple, said that these numbers are ‘hard to comprehend’. He’s right: it’s hard to process the fact that the company sold 34,000 iPhones every hour for three months. Bravo – though we should think about the trends implied in those figures. For the sake of argument, say that Apple’s achievement is annualised, so their whole year is as much of an improvement on the one before as that quarter was. That would give them $88.9 billion in profits. In 1960, the most profitable company in the world’s biggest economy was General Motors. In today’s money, GM made $7.6 billion that year. It also employed 600,000 people. Today’s most profitable company employs 92,600. So where 600,000 workers would once generate $7.6 billion in profit, now 92,600 generate $89.9 billion, an improvement in profitability per worker of 76.65 times. Remember, this is pure profit for the company’s owners, after all workers have been paid. Capital isn’t just winning against labour: there’s no contest. If it were a boxing match, the referee would stop the fight.•