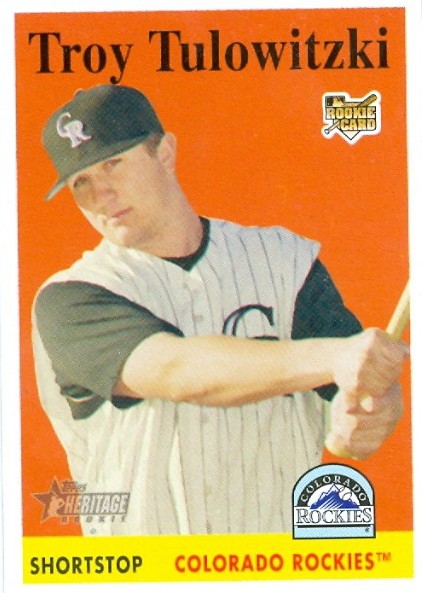

Tulowitzkis, like tulips, are prone to the irrational exuberance of marketplaces. The father of the modern baseball card just passed away, and an Economist piece reminds that speculation for this paper-based memorabilia packaged with bubble gum has proven no more resistant to bubbles than tech stocks or real estate. An excerpt:

Through the 1970s cards appealed mostly to kids interested in finding pictures of their heroes, or in completing a collection. Yet a subtle change was under way. Older aficionados, many of whom had been building their collections for decades, began swapping cards and hunting for especially rare and valuable specimens. One such cardhound, a professor of statistics named James Beckett, began polling traders on the prices they had seen or paid for particular cards. In 1979 he put together the first edition of what would become a regular price guide. In late 1984 the Beckett guide went monthly, the better to capitalise on soaring interest. Not long after that your correspondent took up collecting cards, just as that interest was turning into a speculative fervour.

Mr Beckett may not deserve sole credit for the baseball-card bonanza, but it is hard to imagine the mania having erupted without him. In the 1970s only aficionados knew that unique cards were fetching higher prices at trade shows and auctions. Beckett Baseball Card Monthly helped create a much larger market for the cards. Readers everywhere could see how prices were moving around the country, and decide to sell old memorabilia—or fill their attics with cards in anticipation of future price rises.

Economists have wrestled with the question of whether markets are “efficient” or not for more than half a century. Eugene Fama was awarded a Nobel prize in 2013 for pioneering work demonstrating that markets quickly incorporate new information and cannot systematically be beaten. Yet others reckon markets often go haywire. Robert Shiller, for instance, showed that market returns could in fact be predicted at longer time horizons. He also reckoned people are prone to certain behavioural tics, misjudgments that depart from rationality and which can drive markets to heights of ‘irrational exuberance.’ He was also awarded the Nobel prize, jointly with Mr Fama. Other economists have investigated ways in which markets can overshoot in one direction or another. “There are idiots,” Larry Summers once wrote in a paper on the subject. “Look around.”•