The Hyperloop sprang directly from the fertile mind of Elon Musk, but should his tubular dream take off across the futuristic test tracks to be built in Texas and then in the wider world, the Uber investor Shervin Pishevar will have played a key role, having nudged his buddy to make public the plans before putting a team together to attempt to will the travel system into reality. Pishevar had previously hoped to employ pneumatic tubes for a different purpose: to shuttle documents in the manner of New York’s long-lost pneumatic-mail service. From Bruce Upbin at Forbes:

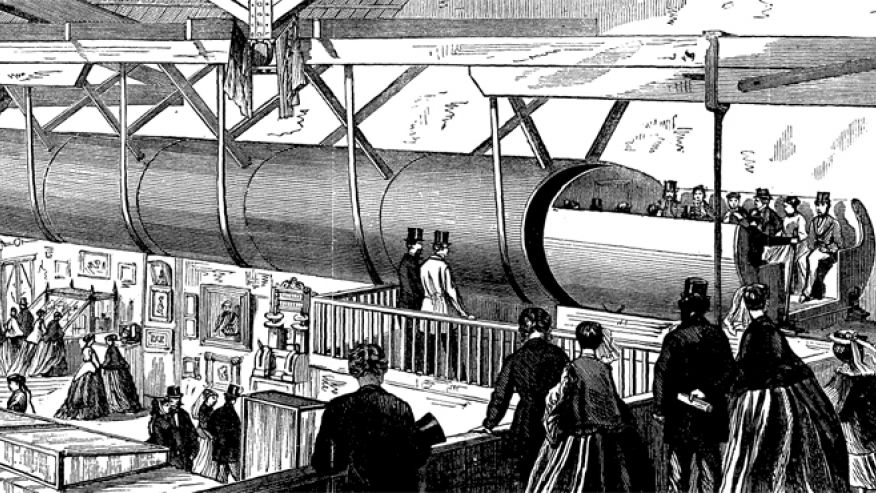

Sci-fi writers and other dreamers have long envisioned fast, tubular travel. Rocketry pioneer Robert Goddard in 1909 wrote a paper that wasn’t too far off from Musk’s proposal. In 1972 Robert Salter of the RAND Corp. conceived a supersonic transcontinental underground railway called the Vactrain. Shervin Pishevar was one of those dreamers. Back in the dot-com era he floated an idea called Pipex, a network of pneumatic tubes that would shuttle important documents around San Francisco. It didn’t go anywhere.

But Pishevar has. Mention his name around Silicon Valley and you might well get an eye roll. A big-hearted oversharer quick with hugs, tears and humble-brags, he drops the names of celebrity friends (Jay Z, Edward Norton, Sean Penn) likes dimes in a jukebox.

“He’s unquestionably a promoter,” says one Valley investor who’s done deals with him. “But there are many good things that come from being a promoter.” Ask anyone at Menlo Ventures, where Pishevar engineered one of the $4 billion venture firm’s greatest investments ever, in a then-small-but-growing taxi app called Uber.

Pishevar was initially turned down by Uber and its backers when it closed its second round of funding at the end of 2011. Pishevar was giving a talk in Algeria when he got a call from Uber CEO Travis Kalanick, saying he was back in if he could come meet Kalanick in Dublin. Pishevar grabbed the next flight to Ireland. “I didn’t really know Shervin, [but] I was getting e-mails from him and intros from everybody he knows,” Kalanick told FORBES in 2012. “I met with him because I had to.” The two hit it off, walking the streets of Dublin for hours. They signed a term sheet in the wee hours of the morning. Menlo left with an estimated 8% of Uber, at a valuation of $290 million. The company is now worth $42 billion. “I always tell people: Lesson number one: Get on that plane,’” says Pishevar, whose Uber and other holdings are worth about $500 million.

That score is the capstone of this immigrant’s rags-to-riches American dream. Pishevar was six when his mother fled post-revolution Iran in 1980, toting him and his two siblings. His father, who had run a big part of Iran’s TV network under the Shah, had barely escaped a year earlier and was driving a cab in Washington, D.C. His mother, a teacher, got a job as a maid at a Ramada Inn. Pishevar’s English was so bad that his second-grade teacher threatened to hold him back until his father pressed her to let him move up. By the time he was 10, though, he was calling local radio stations and debating Middle Eastern politics. “I think he was born 40 years old,” says his brother Afshin, who sold his law firm to move to L.A. as Hyperloop’s general counsel.

After graduating from Berkeley in 1998, Pishevar returned to Maryland and started a series of companies, including an early operating system, WebOS, as well as the Social Gaming Network and Webs.com, which eventually sold to Vistaprint for $117.5 million. In 2007 he moved to San Francisco and began writing small checks to startups on the side. Menlo Ventures hired him as an investing partner in June 2011, and he got the San Francisco firm into Tumblr, Warby Parker and Uber.

Two years ago Pishevar raised $153 million to start his own fund, Sherpa Ventures, with former Goldman Sachs venture investor Scott Stanford. Rather than only backing existing startups, their idea was to build new companies from scratch around talented people. One of the first ideas he put in motion: Hyperloop Tech.•