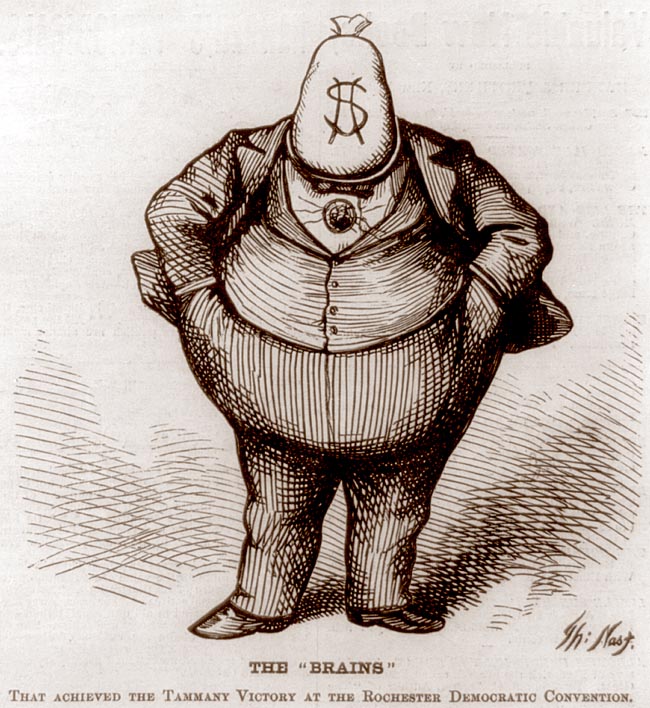

The Sarandon Plan, the theory of the politically challenged actor Susan Sarandon which asserted that the election of a kleptocrat Donald Trump would lead to a revolution that obliterates wealth inequality and other social ills, was not the optimal one. A lot of people get hurt in this scenario.

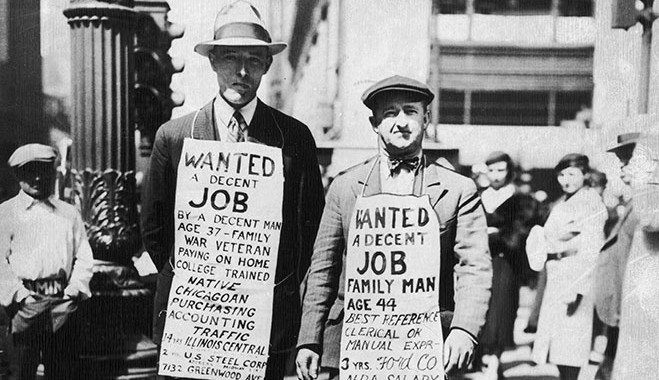

We would be better off electing politicians who alter tax policy, invest in education and work to remove outsize wealth from the political process. Perhaps we could also institute something like the National Service system I’ve suggested, in which maintenance of health, environment and infrastructure would provide good jobs, so that we’re not a nation of “iPhones and potholes.” It won’t be easy, but neither were the challenges of the Gilded Age, the Industrial Revolution or the Great Depression. Major things can be accomplished despite huge obstacles.

In a Marketwatch article, Steve Goldstein writes of a new study by Thomas Piketty and others which reveals the bottom half of American households to be cratering financially. What follows is the opening of that piece and a few exchanges from a Reddit AMA the writer conducted in relation to the findings.

A new research paper from economists including Thomas Piketty finds that the bottom 50%’s share of income in the United States is “collapsing.”

The paper, written by Facundo Alvaredo, Lucas Chancel, Piketty, Emmanuel Saez and Gabriel Zucman, studies global inequality dynamics. And while there are rising top income and wealth shares in nearly all countries, the magnitude varies substantially.

In the U.S., between 1978 and 2015, the income share of the bottom 50% fell to 12% from 20%. Total real income for that group fell 1% during that time period.

That’s not the case elsewhere. In China — where there also has been a marked rise in income inequality — the bottom 50% saw their income go up by 401%, not surprising given the industrialization the world’s second-largest economy has seen. Even in developed France, however, the bottom 50% saw their income grow, by 39%.

Like income, wealth also has become more concentrated around the world.

The economists say that the varying magnitude suggests different country-specific policies and institutions matter greatly.•

Question:

Steve Goldstein:

I don’t, but then, that’s because it would hurt me. And obviously no U.S. policymaker would be in favor, either.

The point is, should eliminating income inequality be the number-one priority? The authors noted that in China, where income inequality also has skyrocketed, so too has the living standards of the bottom 50%. Now, China is in a different stage of the economic cycle than the U.S., but the point is if the pie is growing — and everyone is getting a reasonable slice — people won’t worry as much about the size of their slice.

Question:

Steve Goldstein:

Universal basic income is a really interesting idea — particularly if, as technology advances, fewer laborers will be needed. The new experiment in Finland along those lines will certainly be closely watched.

Question:

Is rising income inequality today tied to the financialization of the economy in the 70s?

Steve Goldstein:

Tough question. I suspect the greater share of finance activity in the economy is the result of broader changes — laws and technology — then the cause.

Question:

Should we all share equally in all money or should be paid out according to your value?

Steve Goldstein:

I think regulated capitalism is the best economic system out there, for fairness and living standards alike. Small-scale sharing societies (e.g., a kibbutz) can work, but at large scale they have been a disaster.

Question: