Earlier today, I posted a piece about Russian entrepreneur Yuri Milner, who’s bankrolling an attempt at an unpeopled reconnaissance mission to Alpha Centauri. A techno-optimist the way most high flyers in Silicon Valley are, Milner believes our increasing connectedness, including the Internet of Things, will bring about a more prosperous world–even a “global brain,” which will unite us all and serve as a “global central nervous system.” That new wealth may be distributed very unevenly, but the wholesale connectivity will likely arrive sooner than later. It will be both boon and bane.

From a Reuters report Chrystia Freeland filed in 2001, just twelve days after the 9/11 attacks:

Milner almost perfectly represents a global technology elite whose frame of reference is planet Earth. He mostly lives in Moscow, but has recently purchased a palatial home in Silicon Valley. He addressed the Ukrainian conference by video link from Singapore.

From that vantage point, the most pressing issue in the world today isn’t recession and political paralysis in the West, or even the rapid development and political transformation in emerging markets, it is the technology revolution, which, in Mr. Milner’s view, is only getting started. Here are the changes he thinks are most significant:

• The Internet revolution is the fastest economic change humans have experienced, and it is accelerating. Mr. Milner said two billion people are online today. Over the next decade, he predicts that that number will more than double.

• The Internet is not just about connecting people, it is also about connecting machines, a phenomenon Mr. Milner dubbed “the Internet of things.” Mr. Milner said that five billion devices are connected today. By 2020, he thinks more than 20 billion will be.

• More information is being created than ever before. Mr. Milner asserted that as much information was created every 48 hours in 2010 as was created between the dawn of time and 2003. By 2020, that same volume of information will be generated every 60 minutes.

• People are sharing information ever more frequently. The pieces of content shared on Facebook have increased from 140 million in 2009 to 4 billion in 2011. We are even sending more e-mails: 50 billion were sent in 2006, versus 300 billion in 2010.

• The result, according to Mr. Milner, is the dominance of Internet platforms relative to traditional media. “The largest newspaper in the United States is only reaching 1 percent of the population.” he said. “That compares to Internet media, which is used by 25 percent of the population daily and growing.”

• Internet businesses are much more efficient than brick-and-mortar companies. This was one of Mr. Milner’s most striking observations, and a clue to the paradox of how we find ourselves simultaneously living in a time of what Mr. Milner views as unprecedented technological innovation but also high unemployment in the developed West. As Mr. Milner said, “Big Internet companies on average are capable of generating revenue of $1 million per employee, and that compares to 10 to 20 percent of that which is normally generated by traditional offline businesses of comparable size.” As an illustration, Mr. Milner cited Facebook, where, he said, each single engineer supports one million users.

• Artificial intelligence is part of our daily lives, and its power is growing. Mr. Milner cited everyday examples like Amazon.com’s recommendation of books based on ones we have already read and Google’s constantly improving search algorithm.

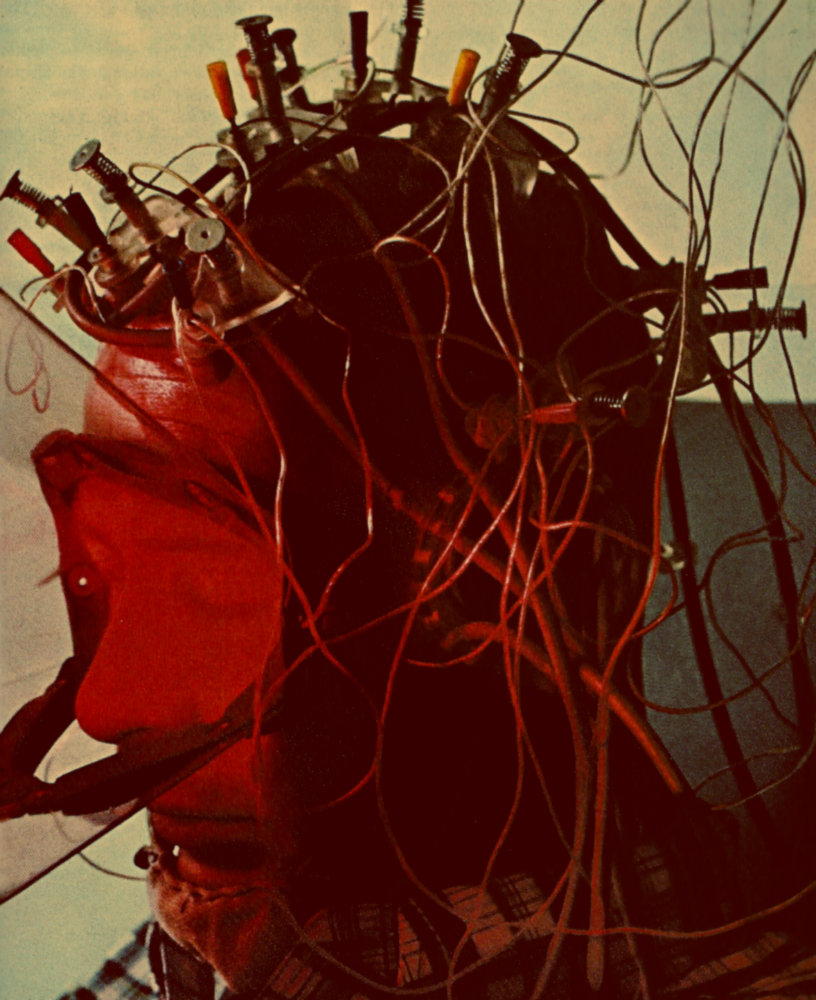

• Finally — and Mr. Milner admitted this was “a bit of a futuristic picture” — he predicted “the emergence of the global brain, which consists of all the humans connected to each other and to the machine and interacting in a very unique and profound way, creating an intelligence that does not belong to any single human being or computer.”•