“The Market We Have Now Is Nothing Like That”

February 3, 2017 in Excerpts, Politics, Science/Tech, Videos | Permalink

In 1960, Edward O. Thorp, mathematics professor with a wandering intellect, co-created with Claude Shannon what’s accepted as the first wearable computer, a stealth gambling aid that helped him level the odds at casinos. After cashing in his chips, he tried his hand at the financial industry to spectacular results. But Thorp, now 84, isn’t sanguine about Wall Street, which he believes is rigged for the already wealthy, and he’s apoplectic about our new President, a feeling which will only be exacerbated by today’s news that the Administration wants to undo the Dodd-Frank Act.

John Authors of the Financial Times interviewed Thorp, who just published his autobiography, A Man for All Markets.

An excerpt from FT:

So, why is he so negative about Wall Street? Without raising his voice, he launches an indictment. “Adam Smith’s market is a whole lot different from our markets. He imagined a market with lots of buyers and sellers of things, nobody had market dominance or could impose things on the market, and there was a lot of competition. The market we have now is nothing like that. The players are so big that they control the levers of financial policy.”

…I ask what he suggests we do about it? “The banks who are too big to fail should have been allowed to fail. Their shareholders should have had to pay the price. Big companies go through organised bankruptcies. Why is it that we couldn’t afford for the banks to go bankrupt? It’s that they are so influential. They can persuade the government not to let them go bankrupt.”

He also holds that banks’ speculative arms should be broken off — essentially a return to the Depression-era Glass-Steagall law that was controversially repealed by President Clinton in 1999. The newly elected President Trump — we are lunching on the first Monday of his presidency — was elected on a platform of bringing back Glass-Steagall, but now appears intent on deregulation. Thorp winces at the mention of Trump’s name, saying he is as negative about him as it is possible to be.•

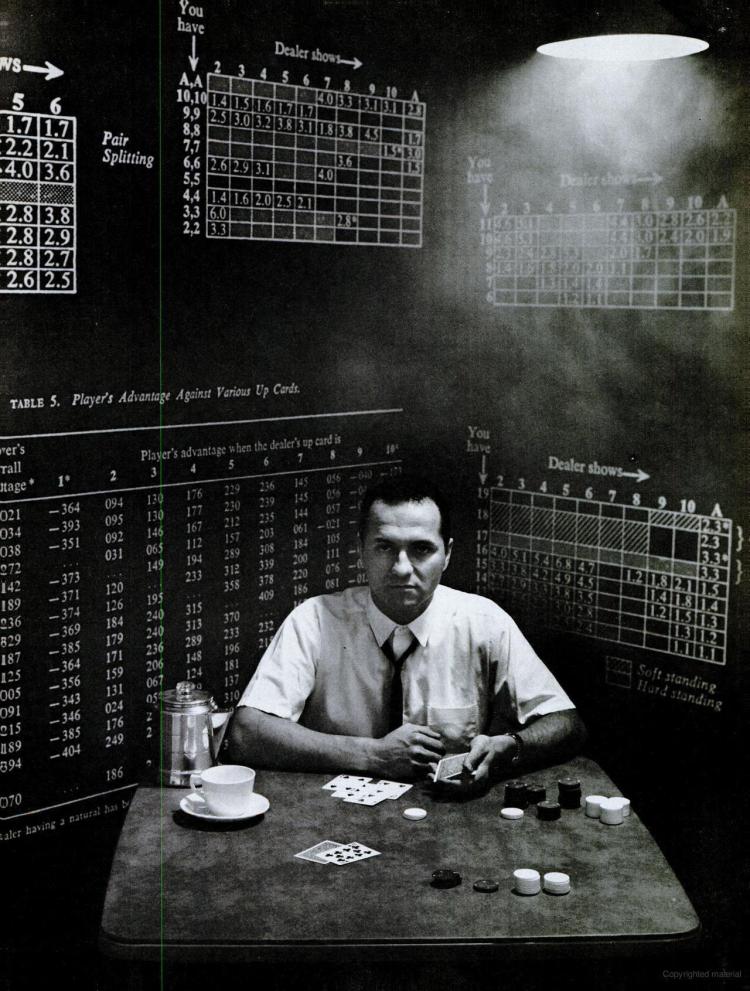

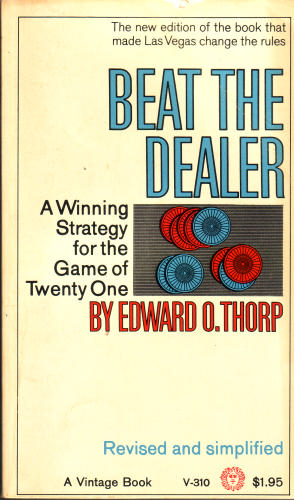

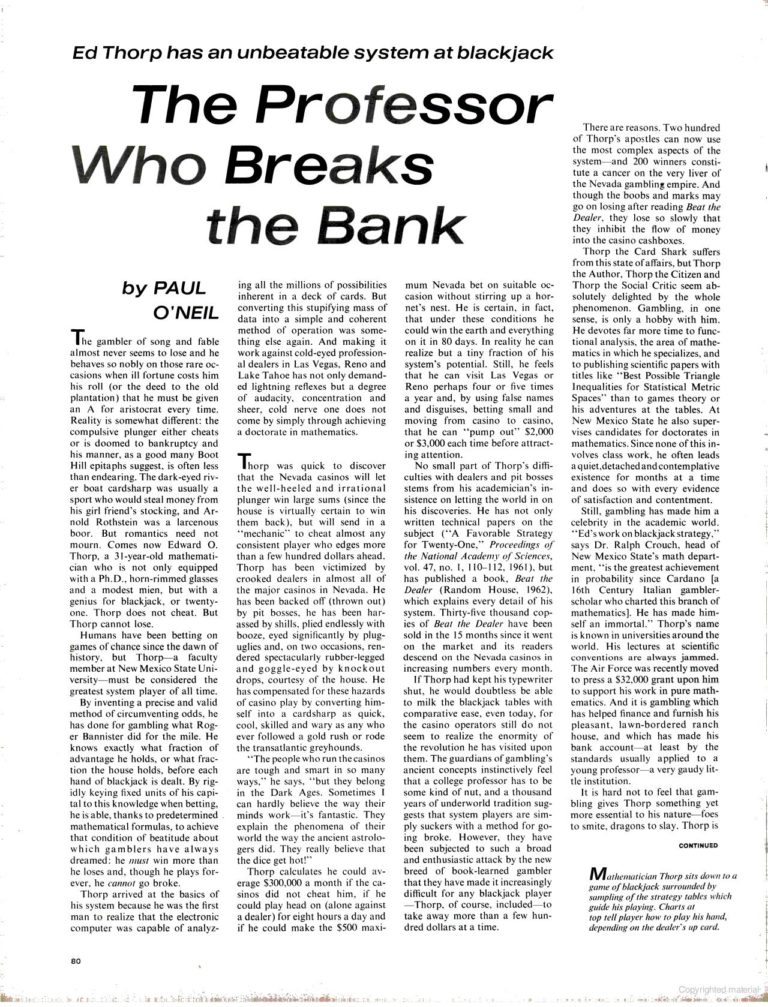

Life magazine profiled the academic-gambler in 1964. The story’s hook was undeniable: a brilliant mathematician who utilized his beautiful mind at gaming tables to bring pit bosses to heel. He didn’t rely on the fictional “hot hand” but instead on cool computer calculations. What wasn’t known at the time–and what Thorp didn’t offer to reporter Paul O’Neil–is that the Ph.D. had a stealthy sidekick in the aforementioned wearable.

The wearable device, which was contained in a shoe or a cigarette pack, could markedly improve a gambler’s chance at the roulette wheel, though the bugs were never completely worked out. From a 1998 conference:

The first wearable computer was conceived in 1955 by the author to predict roulette, culminating in a joint effort at M.I.T. with Claude Shannon in 1960-61. The final operating version was rested in Shannon’s basement home lab in June of 1961. The cigarette pack sized analog device yielded an expected gain of +44% when betting on the most favored “octant.” The Shannons and Thorps tested the computer in Las Vegas in the summer of 1961. The predictions there were consistent with the laboratory expected gain of 44% but a minor hardware problem deferred sustained serious betting. They kept the method and the existence of the computer secret until 1966.•

Thorp appeared on To Tell the Truth in 1964. He didn’t discuss wearables but his book about other methods to break the bank. Amusing that NYC radio host John Gambling played one of the impostors.

Tags: Edward O. Thorp, John Authors

Subscribe to my free Substack newsletter, "Books I Read This Month." It's published on the final day of each month. Some new titles, some older, some rare.

Categories

About

Afflictor.com is the website of Darren D’Addario. Except where otherwise noted, all writing is his copyrighted material. ©2009-18.