Even many economists who’ve made their bones doing macro often encourage the next generation to do micro (while continuing to do macro themselves), but something tells me the attraction of being a “big-picture thinker,” no matter how fraught that is, won’t simply dissolve.

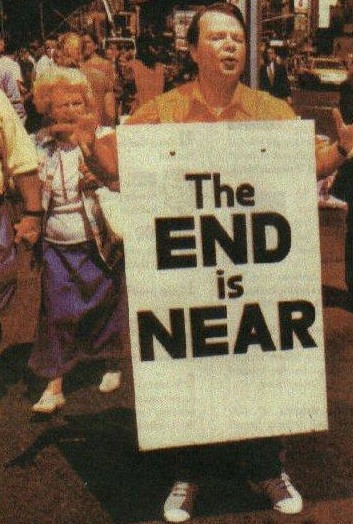

In his Foreign Policy piece, “Requiem for the Macrosaurus,” David Rothkopf argues the opposite, believing that macroeconomics is entering into obsolescence, that the sweep of history can’t be framed in blunt terms as it’s occurring. He feels now is the moment to move beyond this “medieval” state, with real-time Big Data leading the way. Rothkopf’s contention would certainly explain why traditional measurements seem inept at understanding the new normal of the Digital Age–why nobody knows what’s happening. An excerpt:

Being wrong has long been a special curse of economists. You might not think this would be the case in a so-called “science.” But, of course, all sciences struggle in those early years before scientists have enough data to support theories that can reflect and predict what actually happens in nature. Scientists from Galileo to Einstein have offered great discoveries but, due to the limits of their age, have labored under gross misconceptions. And in economics we are hardly in the era of Galileo quite yet. It is more like we are somewhere in the Middle Ages, where, based on some careful observation of the universe and a really inadequate view of the scope and nature of that universe, we have produced proto-science—also known today as crackpottery. (See long-standing views that the Earth was the center of the solar system or the belief that bleeding patients would cure them by ridding them of their “bad humors.”)

Modern economic approaches, theories, and techniques, the ones that policymakers fret over and to which newspapers devote barrels of ink, will someday be seen as similarly primitive. For example, economic policymakers regularly use gross estimates of national and international economic performances—largely aggregated measures based on data and models that are somewhere between profoundly flawed and crazy wrong—to assess society’s economic health, before determining whether to bleed the economic body politic by reducing the money supply or to warm it up by pumping new money into its system. Between these steps and regulating just how much the government spends and takes in taxes, we have just run through most of the commonly utilized and discussed economic policy tools—the big blunt instruments of macroeconomics.

I remember that when I was in government, those of us who dealt with trade policy or commercial issues were seen as pipsqueaks in the economic scheme of things by all the macrosauruses beneath whose feet the earth trembled, whose pronouncements echoed within the canyons of financial capitals, and who felt everything we and anyone else did was playing at the margins.

But think of the data on which those decisions were based. GDP, as it is calculated today, has roughly the same relationship to the size of the economy as estimates of the number of angels that can dance on the head of a pin do to the size of heaven. It misses vast amounts of economic activity and counts some things as value creation that aren’t at all.•

Tags: David Rothkopf