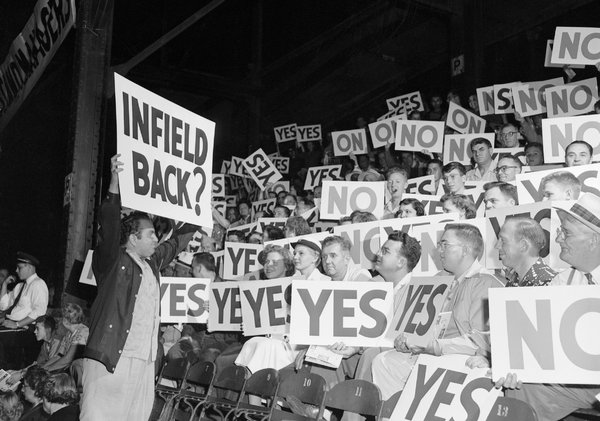

Legendary baseball team owner Bill Veeck was, sure, a carny and a wreck, but he was also an innovator, as you can see in the above photo of him employing a decidedly lo-fi crowdsourcing technique to allow fans to manage a game. One business “innovation” he championed six decades ago, talking the government into giving an unnecessary tax break to owners of sports teams, has become a gigantic piece of corporate welfare in the modern age of multibillion franchises. It will pay huge dividends to new Clippers owner Stave Ballmer. From David Wharton at the Los Angeles Times:

“Baseball fans remember Bill Veeck mostly for his bizarre stunts.

The maverick team owner once signed a player with dwarfism, then sent the 3-foot-7 batter to the plate to draw a walk.

Another time, he let the crowd hold up placards to dictate in-game strategies to the manager.

But there is a legacy for which the late Veeck is less well-known. During the 1950s, the man who bought and sold three major league franchises over his lifetime was credited with persuading Internal Revenue Service officials to give him a hefty tax break on player salaries.

These deductions have survived, with periodic changes, into the present day. And they could greatly benefit Steve Ballmer after his recent $2-billion purchase of the Clippers.

‘It’s a huge part of this business that never gets talked about,’ said Dennis Howard, a professor emeritus at the University of Oregon’s Warsaw Sports Marketing Center. ‘It changes your sense of what he’s really paying.’

Ballmer could seek as much as half of the purchase price of the team in tax benefits over the next 15 years, according to accountants and sports business analysts familiar with the financial aspects of team ownership.”

Tags: Bill Veeck, David Wharton, Dennis Howard, Steve Ballmer