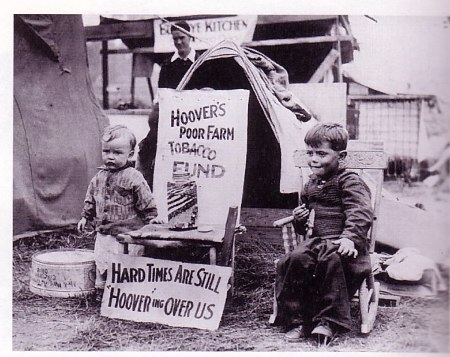

Maybe it’s the fairy tales we’re read as children or the guilt sometimes used to shape us into adults, but our economic policy in the aftermath of collapse is often guided by a false sense of morality. It’s dangerous and can make a bad situation worse, can land us in Hoovervilles. From Paul Krugman’s New York Review of Books piece about a slate of just-published volumes about financial austerity, a passage about the psychology that makes us feel good but is bad for us:

“Everyone loves a morality play. ‘For the wages of sin is death’ is a much more satisfying message than ‘Shit happens.’ We all want events to have meaning.

When applied to macroeconomics, this urge to find moral meaning creates in all of us a predisposition toward believing stories that attribute the pain of a slump to the excesses of the boom that precedes it—and, perhaps, also makes it natural to see the pain as necessary, part of an inevitable cleansing process. When Andrew Mellon told Herbert Hoover to let the Depression run its course, so as to ‘purge the rottenness’ from the system, he was offering advice that, however bad it was as economics, resonated psychologically with many people (and still does).

By contrast, Keynesian economics rests fundamentally on the proposition that macroeconomics isn’t a morality play—that depressions are essentially a technical malfunction. As the Great Depression deepened, Keynes famously declared that ‘we have magneto trouble’—i.e., the economy’s troubles were like those of a car with a small but critical problem in its electrical system, and the job of the economist is to figure out how to repair that technical problem. Keynes’s masterwork, The General Theory of Employment, Interest and Money, is noteworthy—and revolutionary—for saying almost nothing about what happens in economic booms. Pre-Keynesian business cycle theorists loved to dwell on the lurid excesses that take place in good times, while having relatively little to say about exactly why these give rise to bad times or what you should do when they do. Keynes reversed this priority; almost all his focus was on how economies stay depressed, and what can be done to make them less depressed.

I’d argue that Keynes was overwhelmingly right in his approach, but there’s no question that it’s an approach many people find deeply unsatisfying as an emotional matter. And so we shouldn’t find it surprising that many popular interpretations of our current troubles return, whether the authors know it or not, to the instinctive, pre-Keynesian style of dwelling on the excesses of the boom rather than on the failures of the slump.”

Tags: Paul Krugman